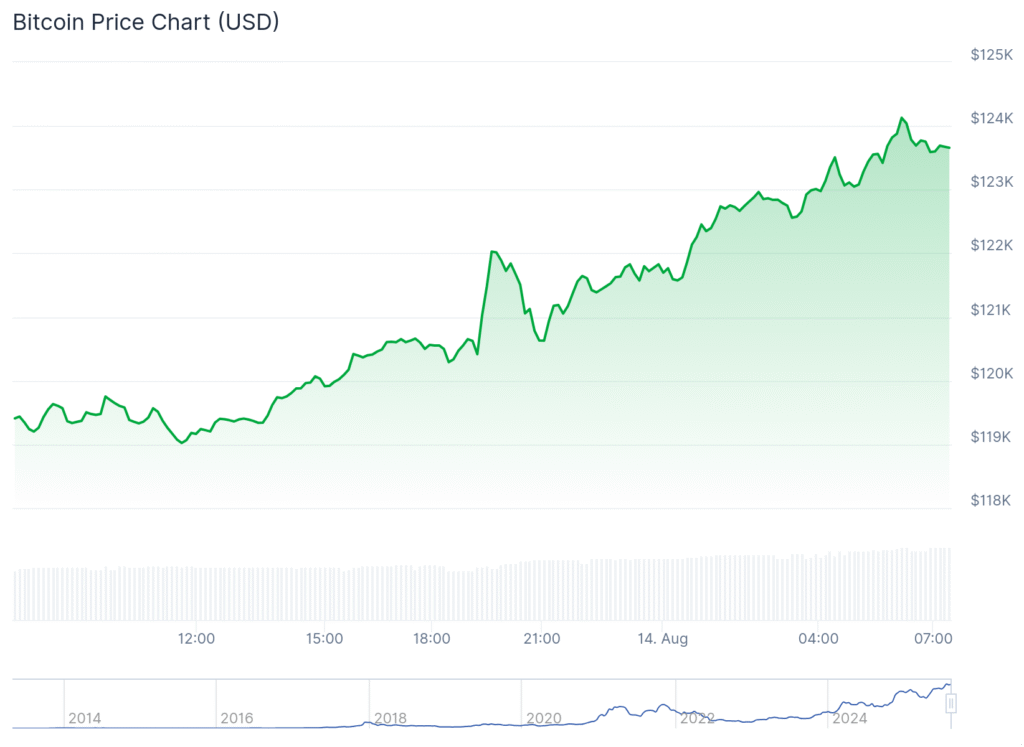

Bitcoin Prices Reach Fresh, All-Time High Above $124,000

Bitcoin has achieved yet another historic milestone, surging past $124,000 to set a new all-time high. This remarkable achievement underscores Bitcoin’s dominant role in the cryptocurrency market and highlights growing global adoption. Investors, analysts, and enthusiasts are closely watching Bitcoin’s performance, as this surge could mark the beginning of an extended bullish phase.

In this extensive analysis, we will explore the factors that propelled Bitcoin to this fresh peak, expert predictions, historical context, and what the future may hold for the world’s most valuable cryptocurrency.

1. Bitcoin’s Journey to $124,000

Bitcoin’s journey has been defined by innovation, volatility, and resilience. From being worth mere cents in its early years to crossing $124,000 today, Bitcoin has undergone an extraordinary transformation. Its adoption as a store of value, medium of exchange, and hedge against inflation has expanded across industries.

The climb to $124,000 wasn’t sudden—it was the result of steady accumulation, growing institutional interest, and global economic shifts that favored decentralized assets like Bitcoin.

2. Key Factors Driving the Latest Bitcoin Surge

Several factors have aligned to drive Bitcoin prices to new heights:

2.1 Institutional Investment

The role of institutional investors in Bitcoin’s price action cannot be overstated. Large-scale purchases by investment firms, hedge funds, and public companies have absorbed a significant portion of available supply.

2.2 Macroeconomic Climate

Rising inflation, currency devaluation, and concerns over traditional financial systems have made Bitcoin an attractive alternative asset.

2.3 Technological Upgrades

Network upgrades, such as improvements to Bitcoin’s scalability and security, have strengthened its fundamentals.

2.4 Supply Dynamics

With only 21 million Bitcoin ever to be mined and the halving events reducing supply, scarcity plays a vital role in supporting price appreciation.

3. Market Sentiment: The Role of Psychology in Bitcoin’s Rally

Market psychology is a crucial driver of Bitcoin’s price. As Bitcoin breaks new records, media coverage and social media discussions amplify the excitement. This creates a feedback loop where rising prices attract more buyers, fueling further gains.

Investor confidence in Bitcoin has grown substantially compared to earlier bull markets. This confidence stems from stronger infrastructure, broader educational resources, and better liquidity.

4. Expert Predictions for Bitcoin

Analysts are split on how high Bitcoin can go in the near term, but many agree that the trend remains bullish. Some forecasts suggest Bitcoin could reach $150,000 or even $200,000 within the next year if current momentum continues.

James Robertson, a well-known crypto strategist, recently stated:

“Bitcoin’s break above $124,000 is not just a technical milestone. It’s a sign that institutional and retail investors are united in their belief in Bitcoin’s long-term potential.”

5. Historical Context: Bitcoin’s Price Milestones

To appreciate the significance of $124,000, it’s worth revisiting Bitcoin’s major milestones:

- 2010: Bitcoin trades for less than $1.

- 2013: Bitcoin reaches $1,000 for the first time.

- 2017: Bitcoin crosses $20,000, attracting global attention.

- 2021: Bitcoin surpasses $60,000.

- 2025: Bitcoin sets a fresh all-time high above $124,000.

Each cycle has been followed by periods of consolidation, yet the long-term trajectory has remained upward.

6. The Role of Regulation in Bitcoin’s Price Action

While regulation can sometimes be seen as a threat to cryptocurrencies, in Bitcoin’s case, clarity often benefits the market. Countries that have implemented transparent guidelines have seen higher adoption rates. Institutional investors, in particular, prefer operating in regulated environments.

7. Bitcoin as a Hedge Against Inflation

One of Bitcoin’s strongest narratives is its role as an inflation hedge. With a fixed supply and decentralized nature, Bitcoin offers a hedge against fiat currency debasement. Investors seeking alternatives to gold have increasingly turned to Bitcoin for its portability, divisibility, and transparency.

8. The Impact of ETFs on Bitcoin Demand

The launch of Bitcoin Exchange-Traded Funds (ETFs) in several markets has made it easier for traditional investors to gain exposure. ETFs reduce the barriers to entry by allowing investors to purchase Bitcoin through their existing brokerage accounts.

9. Bitcoin Mining and Network Security

Bitcoin’s security is maintained through its proof-of-work consensus mechanism. Miners play a crucial role by validating transactions and securing the network. As Bitcoin’s price increases, mining remains profitable, incentivizing continued participation and strengthening network integrity.

10. Risks That Could Impact Bitcoin

While Bitcoin’s outlook is positive, certain risks remain:

- Regulatory crackdowns in key markets.

- Market corrections following rapid gains.

- Technological vulnerabilities.

- Environmental concerns over mining energy consumption.

Investors should approach Bitcoin with an understanding of both its opportunities and risks.

11. Global Adoption of Bitcoin

Bitcoin adoption is accelerating worldwide. El Salvador made headlines by adopting Bitcoin as legal tender, and other nations are exploring similar measures. Businesses across various industries now accept Bitcoin for payments, from tech companies to luxury brands.

12. The Role of Social Media in Bitcoin’s Popularity

Social media platforms have amplified Bitcoin’s visibility. Influencers, analysts, and everyday investors share news, charts, and opinions in real time, creating a constant buzz around Bitcoin.

13. Bitcoin Price Predictions for the Next Decade

Long-term projections for Bitcoin vary, but many believe it will continue to appreciate as adoption grows. Some analysts predict Bitcoin could surpass $500,000 within the next decade, particularly if it continues to replace gold as a store of value.

14. Investment Strategies for Bitcoin

Investors employ various strategies to maximize returns:

- HODL (Hold On for Dear Life): Holding Bitcoin through market fluctuations.

- Dollar-Cost Averaging: Buying Bitcoin at regular intervals to reduce volatility impact.

- Swing Trading: Capitalizing on short-term price movements.

Each approach depends on individual risk tolerance and investment goals.

15. Conclusion: Bitcoin’s Future After $124,000

Crossing $124,000 represents more than a price milestone—it symbolizes Bitcoin’s evolution from a niche experiment to a global financial asset. With rising institutional involvement, growing retail participation, and a favorable macroeconomic backdrop, Bitcoin’s future appears bright.

As Bitcoin continues to challenge traditional financial systems, its journey from here will be closely watched by the world. Whether as an investment, a technological innovation, or a symbol of decentralization, Bitcoin’s impact on the global economy is undeniable.

-

Solana Meme Coins BONK, Dogwifhat, Pengu Plateau – Can RTX Be the Next 1000% Breakout?

Solana Meme Coins BONK, Dogwifhat, Pengu Plateau – Can RTX Be the Next 1000% Breakout? The Solana blockchain has been one of the hottest ecosystems in crypto, giving rise to some of the most explosive meme coins of 2024 and 2025. From BONK’s viral breakout to Dogwifhat’s surge past $3 billion market cap, and Pengu’s

-

Solana Drops To $185 Amid SEC ETF Delay – Analysts Predict Major Breakout

Solana Drops To $185 Support Amid SEC ETF Delay, But Analysts Eye Massive Breakout Introduction The cryptocurrency market continues to face turbulence in 2025, with Solana (SOL) capturing headlines after falling to a critical $185 support level. The decline comes amid delays from the U.S. Securities and Exchange Commission (SEC) regarding approval of a spot

-

Bitcoin and Ether ETFs Hit Record $40B Volume: Biggest Week Ever for Crypto ETFs

Bitcoin and Ether ETFs Hit Record $40B Volume: Biggest Week Ever for Crypto ETFs The cryptocurrency industry has achieved a historic breakthrough. For the first time, combined Bitcoin and Ether ETFs generated over $40 billion in weekly trading volume, cementing their position as two of the most powerful financial products in modern markets. This marks